Emerging markets stocks have taken a beating so far this year. The MSCI Emerging Markets Index is down 13% while the S&P 500 is up 13% year to date. This post, however, is not about emerging markets stocks. As loyal readers know, I keep a hefty portion of my equity investments in emerging markets stocks (See 6/20/13 ’s INVESTORS: HERE’S WHAT TO DO WHEN THERE’S NOWHERE TO GO or…

GIMME THAT OLD TIME RELIGION), but not because I necessarily think they will do well in the six months, year, or even five years. Yours truly owns a disproportionate dollar amount of emerging market stocks because I think that, over the long run, the growth prospects in those markets are better than the growth markets in the developed world. I have no idea what the emerging markets will do in the next year or two years, and that lack of a crystal ball bothers me not a whit.

The Wall Street Journal reports this morning (“Air Goes out of Emerging Stocks,” Saturday/Sunday, 6/29-6/30/13) that, in a poll of 165 “money managers at top investment firms” taken last December by Russell Investments, emerging markets elicited more bullish sentiment than any other asset class. 2/3 of the surveyed managers were bullish on emerging markets stocks, which turned out to be perhaps the worst performing asset class. At least as interesting is now that the emerging markets got pounded despite the professional investors’ bullishness, some of those esteemed pros are now changing their tune and getting bearish, effectively buying high and selling low, which is not the way to make money in the markets.

The larger lesson has little if anything to do with emerging markets; instead, it has to do with the prescience of professional money managers as a group, a group of which I was a part for many years. Judging from their not all that unusual huge miss on emerging markets, professional money managers are about as likely as you are, I am, or anyone is to be right about the short term direction of any market…about 50/50. Perhaps in the wake of the emerging markets call of these esteemed, highly paid money managers, perhaps that 50/50 probability is too generous, but I digress.

The lesson, it would seem, is two-fold. First, completely forget about the short term performance of the asset classes in which you are invested or not invested. The movement of markets, at least in the short term, is nearly completely random, and very, very few people can call those movements no matter how much you pay them, or how much Brylcream they put in their hair. As I have said ad nauseam in the past, the way to make money in the markets while protecting yourself is to invest for the long term according to your risk tolerances and rebalance religiously.

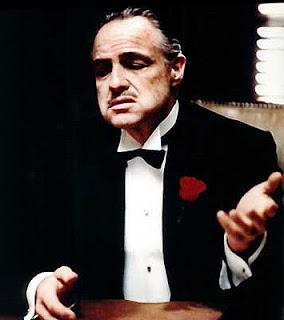

Second, be wary of financial advisors and professional investors. There are many (okay, some) very good ones, several of whom are known to yours truly personally. But there are many more charlatans out there who can do little for you but take your money. To the extent you don’t want to invest on your own, or, in many cases understandably, don’t feel you are capable of doing so, by all means, use a financial advisor. But don’t leave your common sense at the door. And never hire someone to help you with investing based on his or her purported ability to call the direction of markets. As I’ve said before, anyone who thinks s/he can call the markets has not been sufficiently humbled by experience to be entrusted with any of your hard-earned money.

Since this post started out on the emerging markets, I feel compelled to make an observation on those markets, which will not at all affect my generous holdings in those markets. As of yesterday’s close, the price/earning (P/E) ratio of the aforementioned MSCI Emerging Markets Index was 10.7 vs. the S&P’s 15.7 P/E. That’s a very wide spread; normally, the S&P has a lower P/E because of the assumed faster growth in emerging markets. When you combine those numbers with my normally contrarian view of the markets (and of life, but I digress) and consider the newfound bearishness on emerging markets among many in the professional investing community, yours truly is kind of liking those emerging markets. But that view is no reason to go out and buy emerging markets stocks; I don’t have any idea where those, or any, markets are going for the short or intermediate run…but at least I know I don’t know where markets are going.